Login to your Lazo One account here

Login

There is no automatic three-year tax exemption for startups. However, depending on your business activities, structure and location, there are targeted credits and tax-benefit programs that may reduce tax burdens in early years.

Let's address this question directly: according to the IRS, there isn't a general 3-year tax exemption for startups. However, this doesn't mean new businesses are left without support. Various tax benefits and credits are available to help alleviate the financial burden on startups.

Understanding these benefits is crucial for making informed decisions about your business's financial health. While the promise of a straightforward tax exemption might be appealing, the reality is that numerous incentives can provide significant relief.

We hear this question a lot: are startups tax-free for the first three years? That belief usually comes from mixing up specific incentives with a universal rule. In reality, some programs offer limited relief, but there’s no broad multi-year exemption that covers all startups.

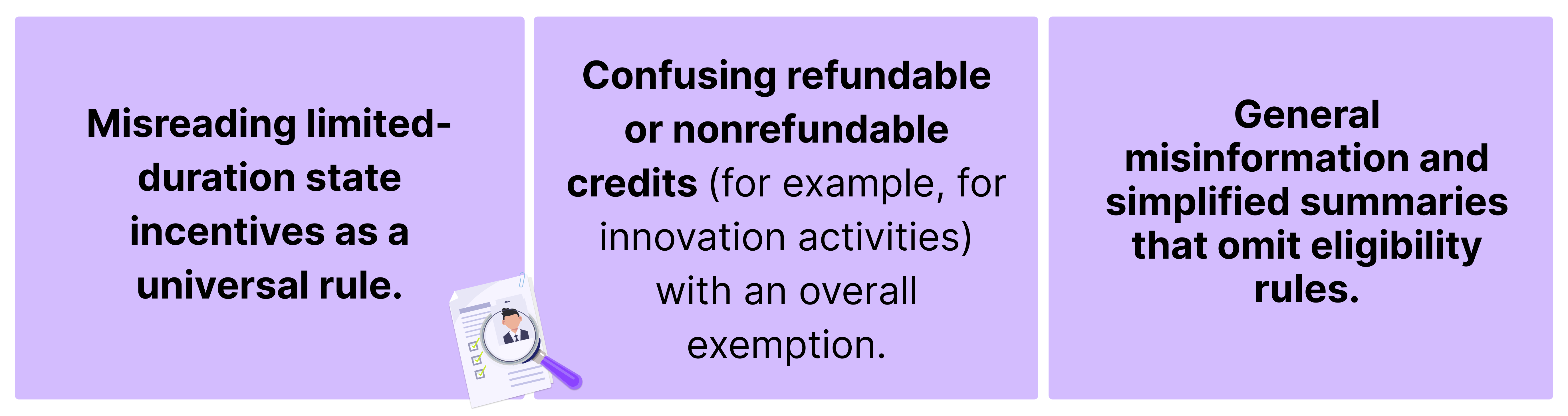

The idea is attractive because founders want to lower early operating costs. Common reasons this myth spreads include:

While a blanket exemption doesn't exist, there are real, targeted tax benefits, like R&D credits and other incentives, that founders should evaluate for their specific business (see our guide to claiming R&D tax credits as a tech startup).

The myth often springs from a few sources:

Understanding these origins helps founders separate useful opportunities from wishful thinking and focus on the benefits they can realistically claim.

Even though a blanket tax holiday isn’t a thing, startups can access targeted incentives that support innovation and growth. These provisions won’t erase all obligations, but they can meaningfully lower liability when you meet the rules.

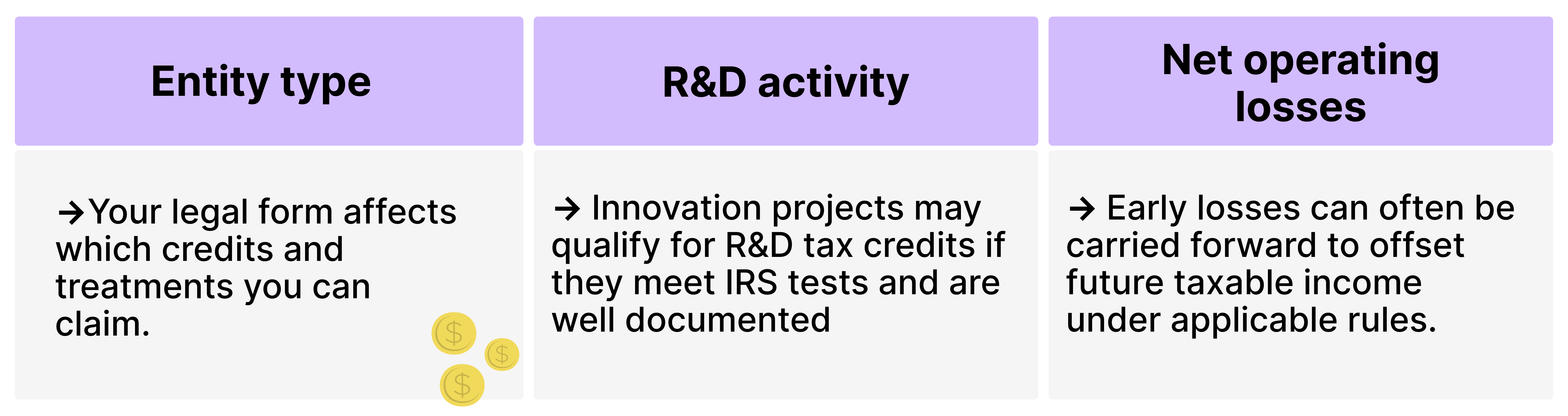

The Research and Development (R&D) tax credit is one of the most useful incentives for innovation-driven startups. If your company undertakes qualified activities, like developing new software features or testing biotech prototypes, R&D credits may apply and reduce tax liability when claimed correctly (see our deeper guidance in the R&D credit guide).

Example: a software startup building a new platform or a lab refining a prototype may be able to capture R&D credits for eligible project costs. Qualification depends on IRS tests and documentation, so plan record-keeping around eligible projects.

Your entity selection meaningfully shapes tax outcomes. Common structures include sole proprietorships, partnerships, LLCs, and corporations; each flows through tax differently and carries tradeoffs regarding investor friendliness and tax treatment.

Choose an entity with both tax and fundraising goals in mind; what’s optimal for day-to-day taxes may not be optimal for capital raises.

Where you incorporate and where you operate are separate decisions. Some jurisdictions are preferred for corporate law and investor familiarity, while others are preferable for state tax posture. Delaware, for example, is commonly chosen for its corporate law framework, but that doesn’t automatically mean lower state taxes for operations.

Consider both incorporation law and the state-level tax consequences where you will hire employees, sign contracts, and generate revenue.

Startups commonly run losses early on. Tax rules allow those losses to be used against future taxable income, subject to statutory limitations and timing rules. That carryforward treatment can smooth tax liability as you scale and become profitable.

Net operating loss provisions are a planning tool, track losses carefully and discuss with your tax advisor how best to use them within your long-term growth plan.

Note: The QSBS (Qualified Small Business Stock) exclusion under IRC §1202 is not a startup tax waiver for operational expenses; it’s a capital gains benefit that applies when qualifying shares are sold after the required holding period. Learn more in Tax benefits of Qualified Small Business Stock (QSBS).

Knowing who qualifies for tax benefits, and where the traps are, is essential for founders. Eligibility depends on technical rules, and small missteps in classification or record-keeping can cost you credits or trigger penalties.

To qualify for tax benefits, startups must meet specific criteria set by the IRS. For instance, QSBS (Qualified Small Business Stock) offers significant tax advantages, but eligibility depends on factors such as the company's business activities and asset allocation.

Another valuable option for some founders is QSBS. The rules address factors like the company’s business activities, gross asset tests, and when shares were acquired — these are technical and should be reviewed with counsel.

Authorities can assess penalties and interest for missed filings or incorrect positions. The simplest mitigation is careful setup and timely filings plus professional advice when rules are ambiguous.

Good tax planning preserves runway and reduces surprises. Treating taxes as part of your strategy, not an afterthought, helps keep cash flow predictable and compliance on track.

These steps provide a solid foundation, but always work with a tax advisor to tailor your plan to your company’s goals.

Lazo helps founders stay on top of tax obligations so they can focus on building product and growing their companies. We combine hands-on bookkeeping, tax planning, and fundraising guidance designed specifically for startups and small businesses.

Accurate bookkeeping is the foundation of strong tax compliance. We keep your financial records organized and up to date, which:

Our team handles the complexities of startup finances so your books stay clean and compliant. Learn more about our bookkeeping services.

We help founders plan and file with confidence by offering:

Equity, convertibles, and debt can create complex tax implications. We help you align your fundraising strategy with your tax strategy so you can grow with clarity and confidence.

At Lazo, we’ve helped hundreds of founders structure their companies for long-term success, from incorporation to fundraising prep.

We’ve seen too many promising startups break apart because they skipped this step.

Our team of legal and financial experts help founders design vesting agreements that make sense for their business model, stage, and investor expectations.

Ready to protect your startup and build investor trust? Talk to us and set up your Founders Vesting Agreement today.

Understanding and using targeted tax benefits is more useful than hoping for a blanket tax holiday. Combine compliant bookkeeping, proactive planning, and the right entity/incorporation choices to preserve runway and scale.

Practical next steps: maintain accurate records, engage a tax advisor when needed, and track deadlines on a compliance calendar.

Ready to replace guesswork with a plan that works?

No, there is no general 3-year tax exemption. Startups can access targeted benefits like R&D credits and NOLs if they meet eligibility rules.

Requirements depend on your entity and activities; at minimum, businesses must register, report income/expenses, and handle payroll-related taxes where applicable.

States tax from day one; review your footprint and see our remote-first state tax guide for common scenarios.

R&D credits may reduce liability for qualifying innovation projects; eligibility hinges on documented activities and expenses (see the R&D guide).

Entity choice determines who pays tax and how income is reported; align the decision with fundraising and ownership plans.

Misclassification, weak documentation for credits, and missing state registrations, fix with disciplined books and early counsel.

Authorities may assess penalties/interest for late or incorrect filings; timely filings and professional advice reduce risk.

Maintain accurate records, pick the right entity, use a compliance calendar, and consult tax professionals to confirm eligibility for specialized benefits.

Record promptly, keep project-level documentation, reconcile regularly, and use cloud accounting to stay audit-ready.

Lazo provides bookkeeping, filing/planning support, and fundraising tax guidance.